Great Tips About How To Increase Npv

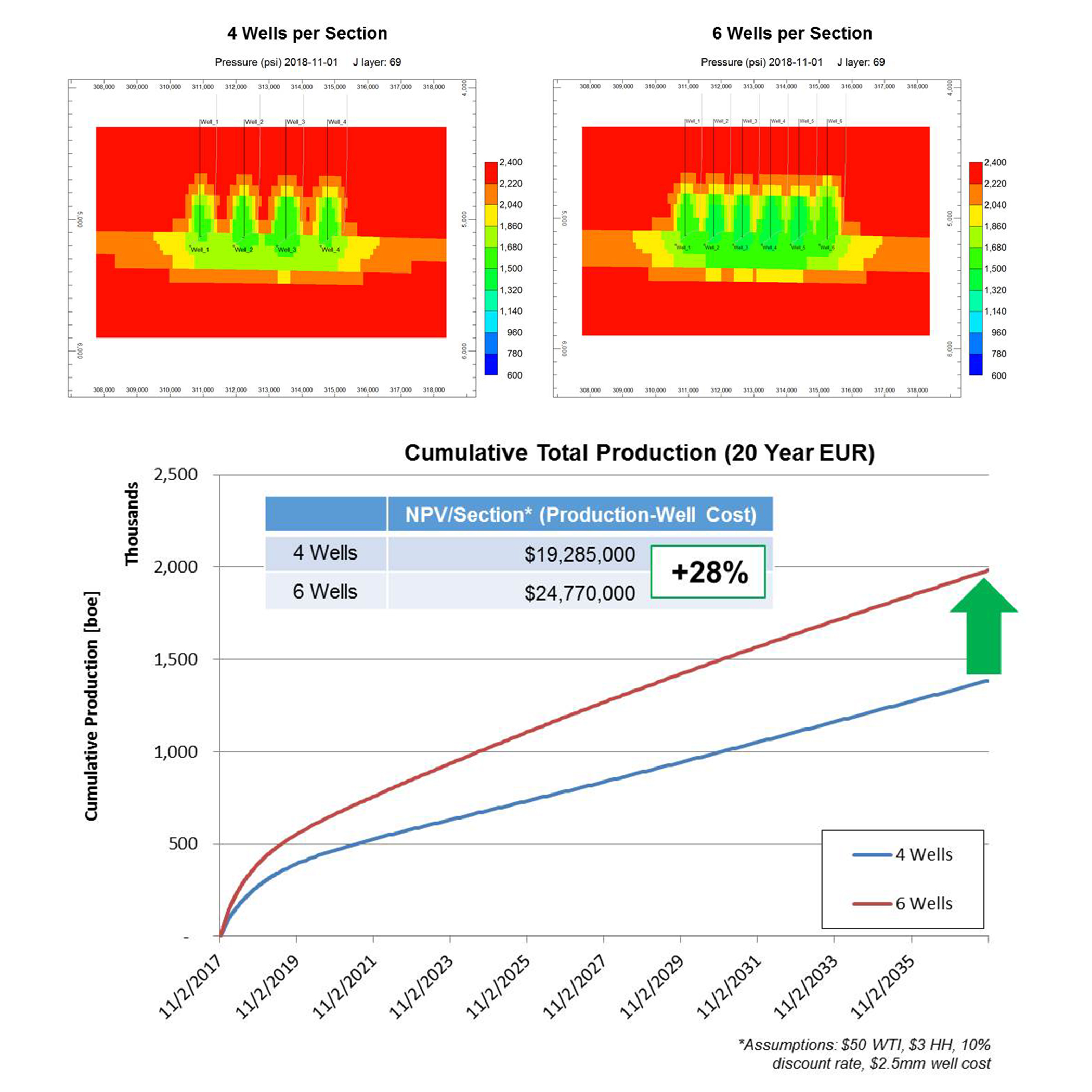

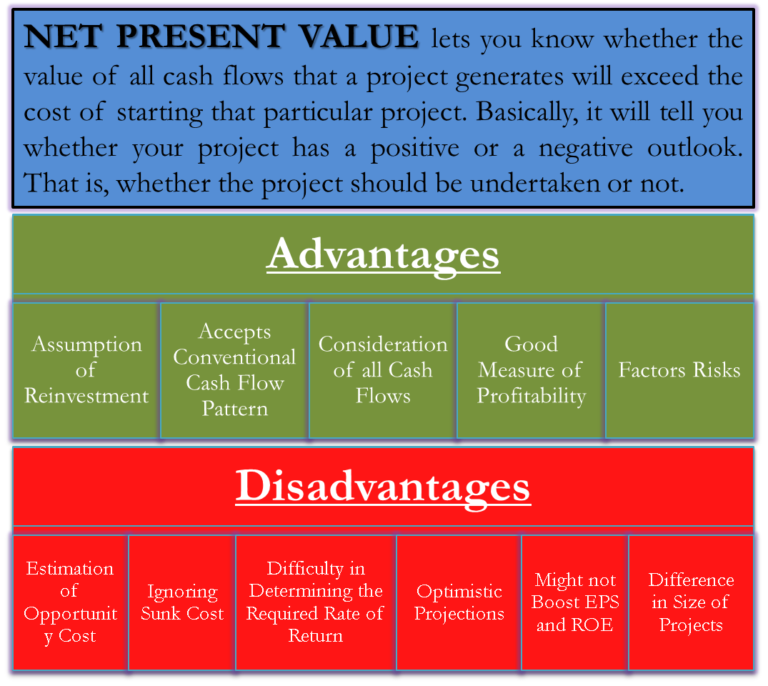

Understanding the net present value rule according to the net present value theory, investing in something that has a net present value greater than zero.

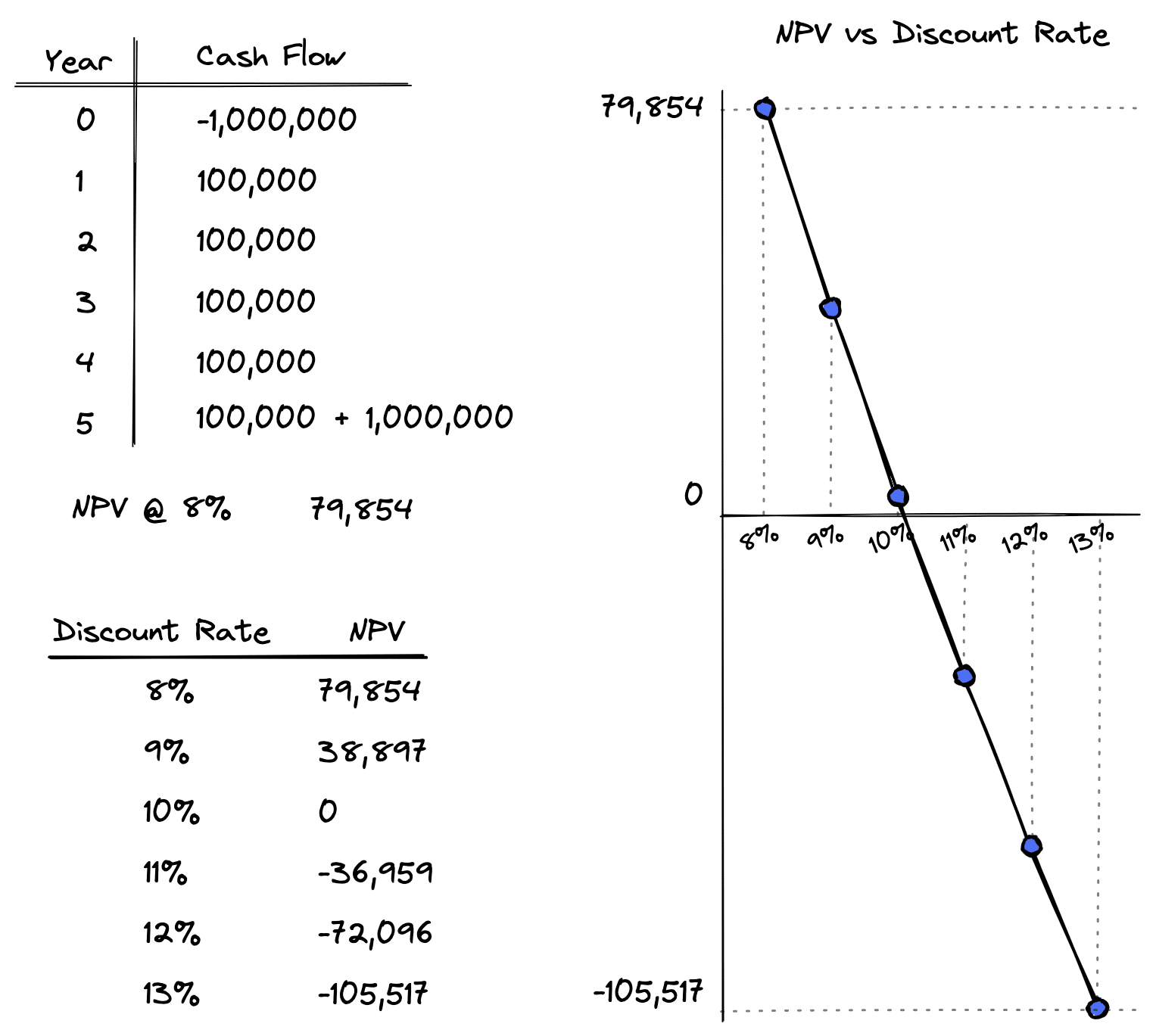

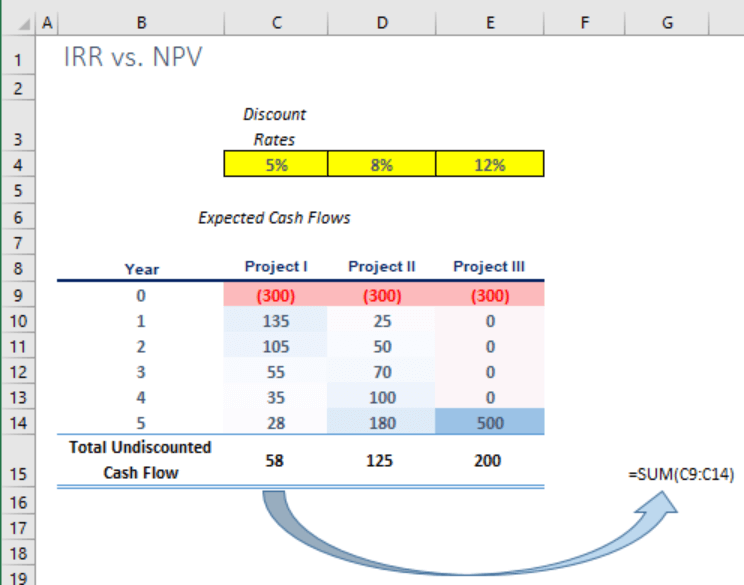

How to increase npv. In excel, there is an npv function that can be usedto easily calculate the net present value of a series of cash flows. $110/ (1+10%)^1 = $100 in other words, $100 is the present value of $110 that are expected to be received in the future. Npv analysis is a form of intrinsic valuation and is used extensively across finance and accounting for determining the value of a business, investment security, capital project,.

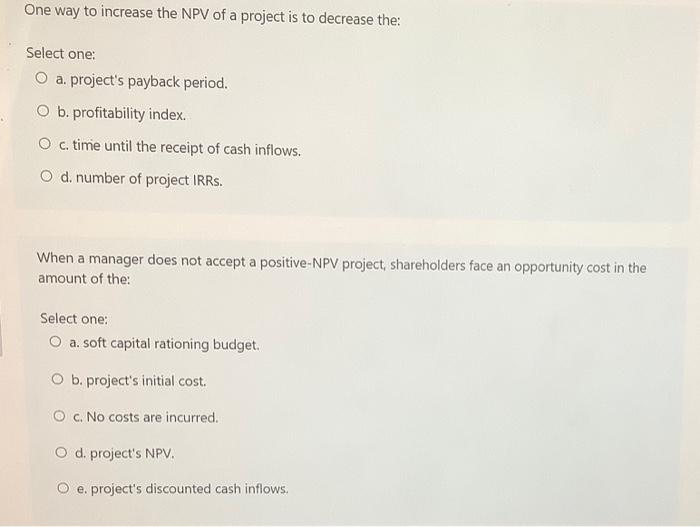

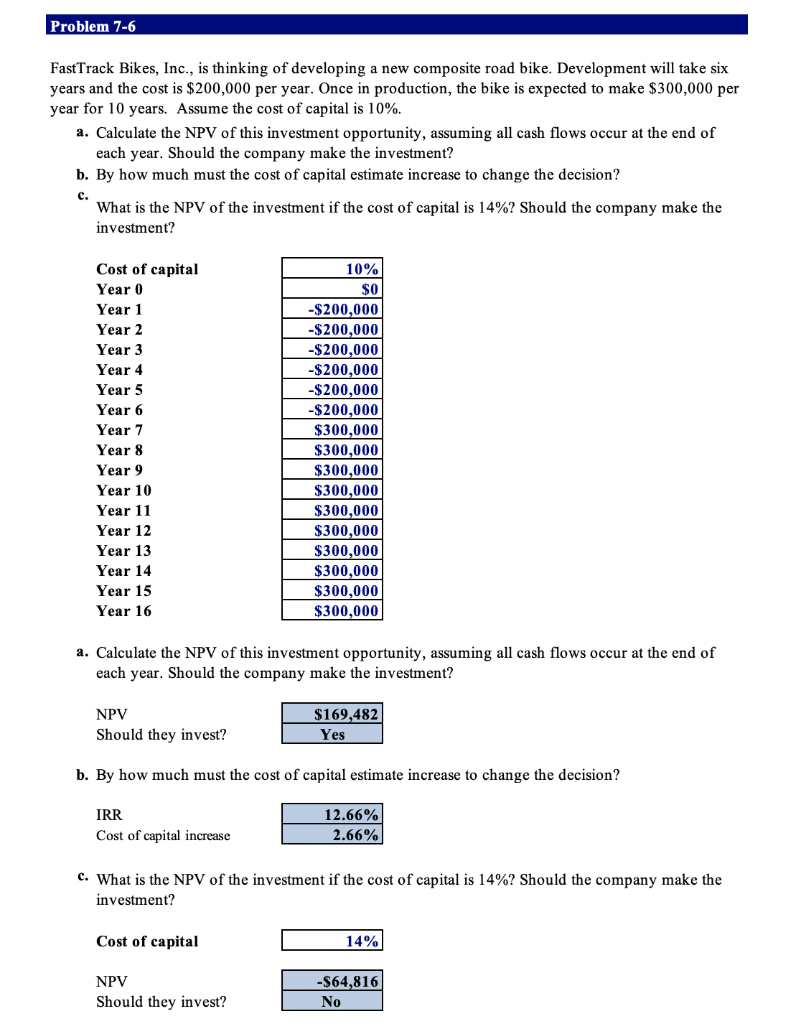

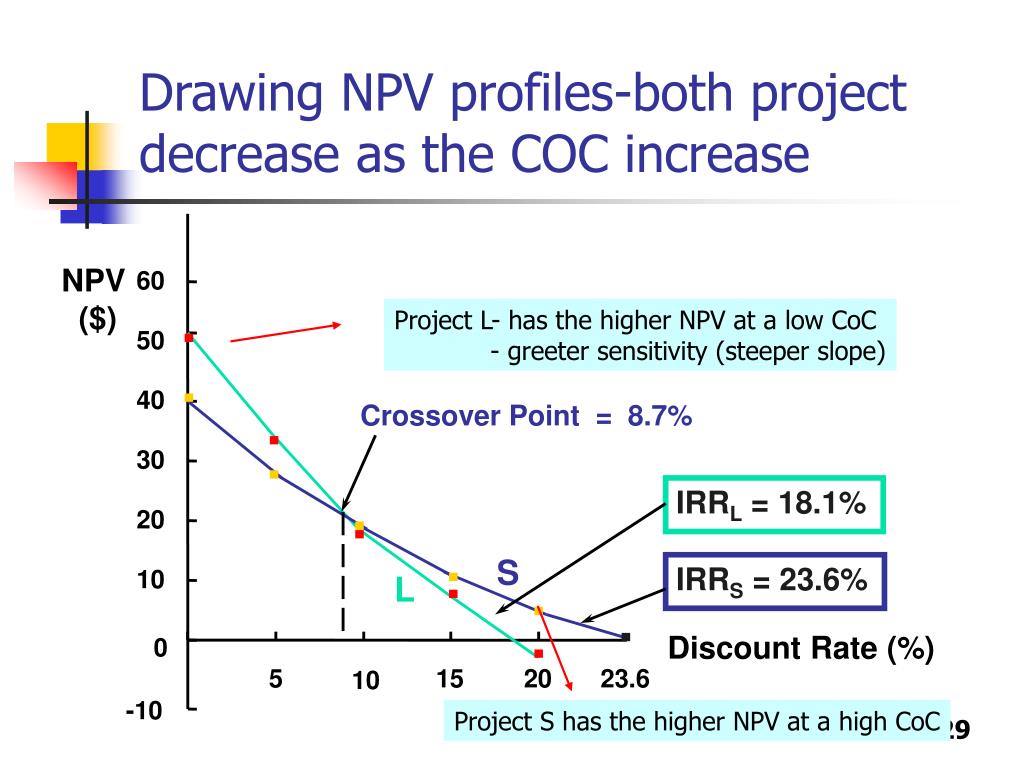

The npv function in excel is simply npv, and the full formula requirement is: After discounting the cash flows over different periods,. A higher discount rate would decrease the npv, while a lower one would increase the npv.

Then we’ll cover how to interpret npv and. Note that the timing of revenues. Net present value (npv) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

He uses npv to evaluate investment opportunities. Npv helps in deciding whether it is worth to take up a project basis the present value of the cash flows. In addition to the required rate of return, a few other factors that might.

First, the npv method uses the time value of money concept. Where r is the discount rate and. To improve sensitivity analysis for npv, you can use more realistic and reliable data for the input variables and update them regularly.

Npv = f / [ (1 + i)^n ] where: All of the cash flows are discounted back to their present value to be compared. So the investment would actually provide a net increase in value of $563.11.

Here is the mathematical formula for calculating the present value of an individual cash flow. In this post, you’ll learn about net present value and the npv formula. Net present value (npv) adds up the.

Net present value (npv) net present value (npv) looks to assess the profitability of a given investment on the basis that a dollar in the future is not worth the. Pv = p resent v alue f = f uture payment (cash flow) i =. The net present value of growth opportunities (npvgo) is a calculation of the net present value of all future.

=npv(discount rate, future cash flow) + initial investment in the example above, the formula entered into the gray npv cell. In practice, npv is widely used to.